Purchase to pay is the full end to end process an organisation will go through from the initial order request of goods or services, through to delivery and payment. It can be called a variety of different things including Procure to Pay, eProcurement or abbreviated to P2P.

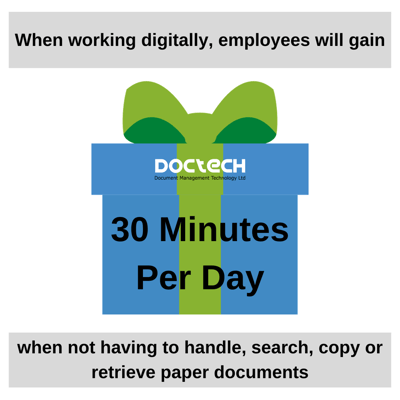

Many organisations that get in touch, talk to us about how their manual processes can no longer cope with the demands of todays business. With the volume of transactions increasing, monthly invoice numbers growing and ever expanding data, paper based and manual processes are slowing down production, creating quality and compliance problems and scalability issues.

Staff waste time cross referencing orders, searching for invoices and chasing approvals. This tedious work can lead to irritated employees who may look for employment elsewhere.

The Great Resignation was a term coined after the COVID pandemic, with large numbers of employees walking away from their jobs. Citing the way their employer treated them combined with working standards, as the reason for leaving. It is these employees who will look for companies that embrace digital strategies, automated workflows and hybrid working.

.png?width=400&height=400&name=11%20times%20v2%20(1).png) Inadequate purchase to pay processes can exacerbate this feeling from staff whilst simultaneously providing management little visibility into spend, performance or supplier relationships.

Inadequate purchase to pay processes can exacerbate this feeling from staff whilst simultaneously providing management little visibility into spend, performance or supplier relationships.

A digital purchase to pay system replaces manual and paper processes with automation. Repetitive tasks can be completed faster and more accurately leading to higher quality processes and results.

A fully automated system enables the digital management of purchase order requisitions, purchase orders (PO), delivery notes and invoices, which can be linked together by the corresponding PO number.

With a purchase order process, a requisition is raised in the system and will be automatically routed to the correct person for approval. Once approved, the purchase to pay system issues the PO to the supplier. When the goods are received along with an invoice, the system can perform a 3 way match.

Purchase to pay automation enables accounting and procurement departments to modernise and stay ahead of the competition. The right system will efficiently capture, store and process information improving invoice processing and approval times.

Management can easily handle suppliers with a back dated history of all purchases made and goods supplied. This enables informed choices to be made and better future predictions based on accurately recorded stats.

A standardised and digital approach to purchase to pay means the process can be rolled out across different locations, whether at home or in the office. This is something that can't be easily achieved with paper or spreadsheets. You can read more about moving from paper based processes to a digital workflow, in our blog.

Ensuring everyone follows the same purchase order process makes it possible to easily track orders, payments and deliveries. There are no nasty surprises for finance when an invoice arrives as they'll have already seen the approved purchase order, or will be able to easily find it in the system.

With all information housed under one roof, reporting is significantly improved reducing the effort required at month end. Improved data capture and analytics can be turned into actionable insights to make informed decisions.

With a purchase to pay system, information is stored digitally removing paper, chaotic network folders and messy email inboxes. Data is secure with encrypted files and password protection. The platform also comes with an ISO 27001 certification making it a better choice for this level of sensitive information.

We can create a tailor made purchase to pay solution that meets organisational needs and follows business rules. It's simple to scale and can grown as the business does, while having the functionality to seamlessly integrate with existing applications such as ERP or finance packages.

Digitised procurement and automated invoice processing will drive efficiency and profitability. As business needs continue to evolve, it's vital organisation's stay ahead of their competition and adopt solutions that reduce risk and deliver higher performance.

If you're looking to regain control over spending, efficiently manage purchases and increase efficiency across finance and procurement, speak with us about a digital, automated purchase to pay system.

We will be able to help.

A purchase order system enables organisations to digitally create, track, manage and approve purchase orders. Our software simplifies and streamlines the entire ordering process, automating tasks and removing the reliance on ...

Processing documents will vary greatly from one organisation to another. How efficiently this happens will be the deciding factor between wasting time and money or staying ahead of the competition.

In this article we explain the basics around Purchase Requisitions vs Purchase Orders for organisations looking to implement a full Purchase Order Process, or for those struggling to control costs.